As the Atlanta technology ecosystem has grown, Mike Dowdle says venture funds have grown with it, leaving entrepreneurs with early-stage companies few options for local investors.

“That’s the natural evolution,” said Dowdle, a serial Atlanta entrepreneur and investor. “It’s very good for the market that these larger funds are in town because they weren’t six years ago. But it’s left a void in the market, so there’s not as many funds going after these really strong companies in Atlanta and the Southeast that are more early stage.”

That’s why Dowdle started Circadian Ventures, a $15 million early-stage fund that targets technology startups founded by veteran entrepreneurs.

“I’ve found that the best deals I’ve seen were the ones with experienced entrepreneurs,” Dowdle said. “I want to be able to work with an entrepreneur that can really navigate the market.”

Dowdle plans to take a generalist approach in terms of tech industries. That means he also wants startups that already have a customer base that he can talk to before investing.

Investments will focus on seed-stage rounds and range between $500,000 to $1.5 million, Dowdle said.

Atlanta Inno's Under 25 of 2020

ATL Vibes and Beatly

Founder: Alexander Zwerner

A couple years ago, Alexander Zwerner, now 18, was reading a review of a Kanye West album in the Rolling Stone. He felt it was another "safe" review that lacked a definitive rating of the album. So Zwerner did what innovators do — he decided to try a new way. He started ATL Vibes at 16 years old and immersed himself in the world of music reviews. By 17, he published "The History of Hip Hop" and started freelancing for EARMILK. Now, he's moving onto his next project, a music review and rating app called Beatly, which he hopes will be the "Rotten Tomatoes for music." The senior in high school taught himself how to code over the summer, and when he gets to college, he wants to find the technical and financial help to continue building out the app.

Emily Knudd

EquiSources

Founders: Olivia Kasper and McKenzie Kasper

These sisters developed a product in the equine industry, specifically in the niche market of equine thermoregulation. The Carry-Cool is a portable kit that helps drop the temperature of a hot horse. The patent-pending wrap design is made from a super-absorbent, contoured material that wraps around the neck of the horse and is carried in an insulated cooler bag with ice packs, where it stays chilled until use. The sisters — Olivia, 25, and McKenzie, 21 — grew up around horses. They run an equestrian farm where they buy, train, compete and sell horses. They understand the need to keep people, animals and supplies cool during hot, humid summers. Their father, who passed away a couple years ago, was the sisters' biggest cheerleader. After he passed, they sisters stayed at home with their mom and enrolled in online undergraduate programs. They've self-funded the company and remain debt free as they expand into new stores and broaden e-commerce options.

Alex Baigas Photography

Ethos Medical

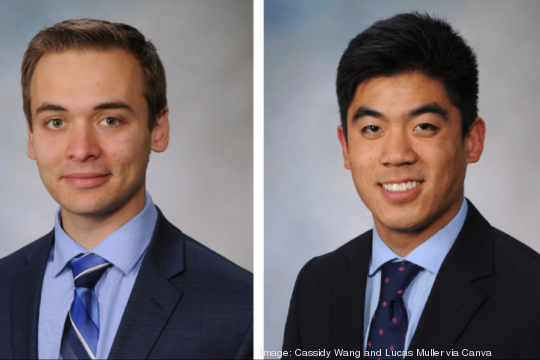

Founder: Lucas Muller (left) and Cassidy Wang and

These two Georgia Tech graduates knew what problem they were trying to solve — the procedural risks of lumbar punctures or spinal taps. But they just didn't know the solution right away. It was when physicians told them that "x-ray vision" would be their biggest help in these procedures that they figured out what to do. Cassidy Wang and Lucas Muller created an attachment that holds a needle and sends an ultrasound image of the patient's spine onto their software. Then, the physician can look at the ultrasound and line up exactly where the needle needs to go to accurately complete the lumbar puncture. The two went through Georgia Tech's Create-X accelerator and won the 2019 Georgia Inventure Prize, where they received $20,000 and a free patent filing, which they are in the process of now. Ethos Medical is now raising a $1 million seed round and hopes to have FDA approval for their device by the 2021's third quarter.

Cassidy Wang and Lucas Muller

FoodFinder

Founder: Jack Griffin

The demand for Jack Griffin's startup exploded when the COVID-19 pandemic hit. His nonprofit, FoodFinder, shows food insecure families across America when and where to get help from nearby food pantries and school meal programs through an app and website. He went from helping 700 people a day with the platform to 3,000, doubling the amount of users from 2019, he said. The most difficult part of the growth has been keeping up, said Griffin, who graduated from college in 2019 and started working on FoodFinder full time. The platform also had to keep up with changes in how food is distributed, food pantries that have opened or shuttered and different hours of operations. He has three full-time and two part-time employees and aims to triple the impact of the platform next year. The nonprofit landed grants from the Walmart Foundation and Inspire Brands Foundation. FoodFinder's goal? To become the first-ever directory of every food pantry in America. The organization has been honored the Technology Association of Georgia, among others, and participated in the University of Michigan’s Techarb Accelerator for Student Ventures.

A Girl's Frontier

Founder: Isha Uppalapati

Isha Uppalapati's gratitude for her own support system led her to create a nonprofit, A Girl's Frontier, dedicated to proving education and mentorship to young girls in metro Atlanta to foster their entrepreneurship potential. The nonprofit hosted an iPad drive over the summer to help students who may not have had technology to do virtual school. Now a senior in high school, Uppalapati also has a book under her belt titled, "Her Toolbox," which gives advice to girls from seven accomplished women. Uppalapati had the idea for the book after conversations with her mentors, who told her lessons she wanted to share with others. The entrepreneurial path felt right for Uppalapati, who remembers constantly cooking up new companies, like cleaning services or car washes, when she was younger. Her parents always supported that spirit, which is why she wants to help other girls who may not have that encouragement.

Isha Uppalapati

Mukja

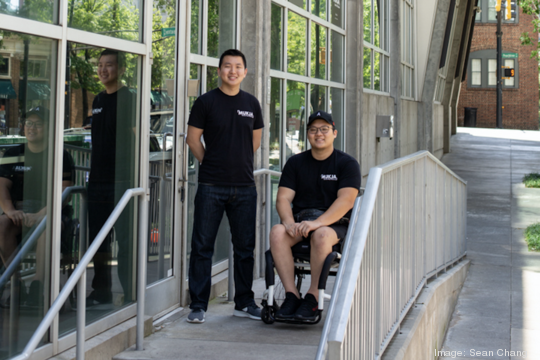

Founders: Peter Chung and Sean Chang

It started with some really good chicken, as Peter Chung tells it. Chung and Sean Chang, both 25, were roommates in college, and Chang was constantly experimenting with new recipes in the kitchen. But it was this particular recipe that eventually led to Mukja, a Korean fried chicken restaurant that opened in October in Midtown. The pandemic delayed the restaurant's planned debut earlier this year, and the duo have been working in overdrive to fix the kinks in their new space and hire staff. They've done mostly take-out orders so far but are hopeful for the day when customers can dine in again. Chang always knew he wanted to work in the restaurant industry, and Chung wanted to be an entrepreneur, so opening their own place made sense.

Sean Chang

MusicBuk

Founder: DuMarkus Davis

It's no secret in the music world that performers often have to teach lessons between gigs to supplement their income. But DuMarkus Davis, a 25-year-old classical violinist, noticed that the hosting music studios often took large chunks of the lesson cost, leaving little for the actual instructor. In the spirit of the tech giants that were in his backyard as he attended San Fransisco Conservatory of Music, he set out to solve the problem. He created Musicbuk, an app that launched in March of 2020, to connect musicians with students without the large fees. With the Musicbuk model, there's a one-time finder's fee per student and a small transaction fee, similar to a food delivery app model. A student can find an instructor, see the times they're available, then schedule a session. The app has about 250 instructors, and all lessons currently take place over Zoom, Davis said. Davis participated in Atlanta Tech Village's It Takes A Village pre-accelerator and the Tech Stars accelerator in Kansas City.

Dumarkus Davis

MyTotem

Founder: Ashley Richardson

Ashley Richardson, 25, bootstrapped a marketing agency after she graduated Georgia State University, but it wasn't long before she realized that marketing her own company was her biggest problem. She needed to pivot, which is how she created MyTotem, a marketing startup that launched in 2019 and aims to be more streamlined and customizable than the original company plan. Clients of MyTotem answer a brand quiz to set expectations for things like aesthetic preferences, industry and company missions. Those clients can subscribe to MyTotem to get new marketing materials every month. In June 2019, Richardson was accepted into the Main Street Entrepreneurs Seed Fund at GSU and won the demo day at the end of the program. Richardson, who's currently raising an angel round, is planning to roll out a new feature that uses artificial intelligence to create that marketing content next year.

Ashley Richardson

The Neos App and A+ Academic Services

Founder: Jordyn Turner

Jordyn Turner, a 20-year-old Emory University student, fell into entrepreneurship while in her hometown of Houston, Texas. She started a tutoring service as a way to make money when she was 16, and within months, she was booked. She started hiring friends and other high school and college students, and before long, she had A+ Academic Services, which is a tutoring service still based in Houston. Through college, she continued running that company while pursuing other opportunities, such as her latest venture — The Neos App. Still in its early stages, The Neos App aims to be a social media platform for young professionals to exchange services, such as someone is looking for a photographer for a headshot. She plans to pilot the app in Atlanta and hopes to work full-time as a startup founder after college.

Jordyn Turner

Press Sports

Founder: Conrad Cornell

Conrad Cornell, 25, had the idea for Press Sports when he kept slipping through the cracks during college recruitment for baseball. If a recruiter came during a bad game, that was it. There were no records of last game's home run or any of his other athletic achievements. He created Press Sports to be that record. Much like how LinkedIn highlights career accomplishments, Press Sports, which launched in 2018, aims to highlight athletic accomplishments, either for recruitment purposes or for fans searching their favorite players. Press Sports closed a seed round led by Overline earlier this year and has executives from YikYak on their team. Cornell created the app after graduating Mercer University and hopes it becomes the next big social media platform out of Atlanta.

Press Sports

Presso

Founders: Nishant Jain and Thibault Corens

Nishant Jain, 24, hated doing laundry while at Purdue University. And really, he still hates it. But that hatred is exactly what pushed him to innovate the laundry business. He and co-founder Thibault Corens created the Presso machine, which automatically presses and disinfects clothes in less than five minutes. Now, his biggest problem is keeping up with demand. He has a handful of Presso machines that he rents out to movie productions so they can clean and press costumes much more quickly than the multiple-day turnarounds at dry cleaners. Presso has backing from SOSV, a global technology venture firm, and Pathbreakers Ventures, a San Fransisco-based firm. Jain plans to double his 11-person team in the next six months. Eventually, he said, Presso will do for laundry what the microwave did for cooking.

Presso

Pickles 'n Pudding

Founder: Ryan Neufeld

Daughter and mother duo Ryan and Adina Neufeld started off sharing a few simple recipes at the farmers market. Now, they run Pickles 'n Pudding, a small-time food business made up of sour pickles and several flavors of pudding — ranging from banana cream to red velvet to pumpkin. Adina takes the salty route, making the pickles. And Ryan, 14, takes the sweet road, making the pudding. The duo sell their products at the Sandy Springs Farmers Market.

Adina Kalish

queues

Founder: Samuel Porta

Samuel Porta, a 21-year-old fourth-year computer science student from New Zealand, started his first business selling candy on the school bus. And he's been an entrepreneur ever since. His latest endeavor is queues, an app that tells you wait times for restaurants, venues and more. The startup has been part of the Georgia Tech Create-X accelerator program, which provided seed funding, and won the Georgia Tech Inventure Prize just before the pandemic set in. Now, with restaurant lines being a lesser concern for many, queues shifted to collecting data to help reduce the spread of the coronavirus by partnering with Georgia Tech to analyze how students congregate in buildings in real-time.

Samuel Porta

Vericrypt

Founders: Grant Nelson, Robert Park and Tamara Zubatiy (pictured)

Vericrypt was born out of a winning pitch at a hackathon. The startup uses artificial intelligence to score bias in news text, and that's no simple thing as the U.S. wrestles with fake news, far-ranging opinions and traditional news sources. Zubatiy, 24, grew up in the Ukraine and saw how media worked in an ex-Soviet-bloc country. Meanwhile, Park grew up in South Korea and worked there as a journalist, and Nelson saw the fall of Suharto in Indonesia and had to evacuate amid violence. So their vantage point always considers the importance of trustworthy news as a foundation of healthy societies. After the hackathon, the startup was in the The Basement Accelerator at UC San Diego. Earlier this year, it was one of 75 teams selected as part of the Georgia Tech CREATE-X summer accelerator. Now, the company is planning to raise a seed round to expand.

Michael Franke

Vitruvian VDR

Founders: Ileana Del Risco (left) and Catalina Del Risco

VitruvianVDR developed a virtual dressing room for online retailers that creates a realistic, 3D model of each shopper and simulates how garments will look on them. Catalina Del Risco, 25, and Ileana Del Risco, 23, were brought on as co-founders by founder and CEO Andrea Del Risco to incorporate Catalina's textile technology knowledge and Ileana's finance and marketing skills. The sisters have already been part of Georgia Tech's Create-X Program, Babson's Women Innovating Now Accelerator and the Envision Accelerator. Retailers can use VitruvianVDR to give their customers a better understanding of how an article of clothing may fit them, which would help with customer experience and reduce returns, Illeana said. The startup hasn't started marketing its product but has 25 retailers on the Shopify App Store that use its size suggestion tool. Now, they're raising a pre-seed round and looking for more developers to enhance their technology.

Ileana and Catalina Del Risco

Dowdle said he’s raised $5 million of the fund right now and has invested in two companies, one in financial technology and the other in marketing technology. He declined to name the companies.

About a dozen of Dowdle’s investors are people he’s worked with while doing syndicate investing for several years, such as David Lerner, the founder of Ascent CPA accounting firm.

With syndicate investing, Dowdle struck deals between different startups and investors, creating a new LLC for each investment. That became a lot to manage, Dowdle said, which is why he started Circadian Ventures.

Dowdle is the lead investor in Atlanta cybersecurity company Apptega through his syndicate investing, and CEO Armistead Whitney said Dowdle has been a helpful asset in growing his company.

“Mike is a skilled operator with deep investment expertise, which means he understands what it takes to scale a business from startup to successful exit,” Whitney said. “His impact on the Southeast will be tremendous with his new fund.”

Dowdle’s love for investing comes from his love for helping entrepreneurs navigate the early stages of their businesses.

“To be able to work with people who are so passionate about changing the world — to participate in just a small part of that — is the most exciting work that I’ve done or could imagine doing,” Dowdle said.

For Dowdle, Atlanta’s one of the best places for that type of entrepreneurial spirit. With the university system, low cost of living and corporate residents, he said “being an entrepreneur is part of Atlanta’s DNA.”

Dowdle started as an entrepreneur when he founded Internet consulting site Webbed Feet in 1995, which was acquired by iXL Enterprises. He went on to found a couple other companies, including CPO Commerce, which Essendant Inc. bought in 2014. He started his investing career in 1998.