Kabbage, an Atlanta-based lending startup, has expanded to a new part of the fintech industry to provide small businesses more cash-flow solutions: a new business checking account.

Traditionally, the fintech unicorn has provided lending services and funding to small businesses through an automated lending platform. Kabbage is among a growing number of fintech startups that are entering the banking space.

"Small businesses have always struggled to get basic financial services from their banks, both in the best of times and worst of times, and the PPP only exacerbated that divide," Kabbage President and Co-founder Kathryn Petralia told Atlanta Inno in an email. "Since day one, we built Kabbage Checking to be a full-service business checking account designed to serve the smallest of businesses. It gives them the banking advantage large businesses enjoy, but without the start-up fees, monthly fees, maintenance fees or overdraft fees—and instead, we pay them so they can better manage and grow their money.”

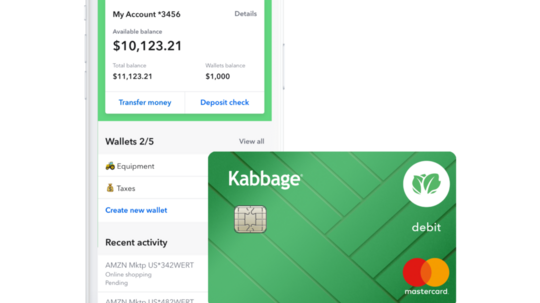

Kabbage Checking works just like a traditional checking account without the monthly fees or friction. There are no fees to open or keep a checking account with Kabbage and no minimum or daily balance requirements. All customers will earn a 1.1% annual percentage yield paid out monthly.

“Amidst one of the largest financial crises in history, we helped over 225,000 small businesses access services many of their long-time bank partners would only provide to their largest customers,” Petralia said in a statement. “We believe in the businesses too often left out, overlooked and underestimated.”

Businesses can join the wait-list for Kabbage Checking. Some features include free ATM access to withdraw cash at one of 19,000 in-network ATMs nationwide; up to five wallets that track savings goals or manage cash flow; bill pay to set up vendors, organize bills and issue electronic payments; and the ability to make cash deposits at one of 90,000 participating retailers and service centers. Kabbage Checking will also support wire transfers and mobile remote deposits when new features launch later this year.

The hope is the new product will launch Kabbage as a full financial-services provider that allows small businesses to accept, deposit, pay, borrow, save and review their funds on one platform. The company's platform is designed to make an easy cash-flow management experience.