Atlanta is ranked the No. 13 startup market in the United States, according to an annual global report by Startup Genome.

Atlanta ranks highly in the quality of talent and research categories of the report, reflecting the city's strong university network. The number of graduates earning tech-related degrees is growing faster in Atlanta than anywhere else in the country. The city is also relatively affordable, has a business-friendly environment and a growing number of corporate tech players — all of which contribute to the cache of its startup ecosystem.

The Startup Genome report comes as the U.S. confronts another economic downturn. The dynamics have already made it harder for Atlanta startups to raise money. Multiple startups are making layoffs to cut costs as company valuations decrease. OneTrust, a local unicorn previously valued at $5 billion, just laid off 950 employees, or about a fourth of its workforce.

But these market corrections come after years of astounding growth in the number of startups in the area, the quality of newly emerging companies and the largest influx of venture capital dollars Atlanta has ever seen.

Startup success during the pandemic

The new Startup Genome report largely reflects the massive growth seen between 2020 and 2021, and not necessarily the undulating markets experienced in the U.S. over the past couple of months. It notes that inflated valuations have boosted overall numbers, but that they can carry risks for startups.

"It often spells lower returns for investors for the affected vintage investments. For startups (and for investors) this raises the specter of down rounds as the market goes back to near-historical valuations before their next round," it says.

While limited on these recent changes, the report paints a vivid picture of how startups largely succeeded, landing record funding dollars and skyrocketing valuations, over the course of the Covid-19 pandemic.

"Since the pandemic, tech companies grew 2.3 times more than their non-tech counterparts," the report said. "While about 90% of startups completely fail, Startup Genome research demonstrates that only 1.5% of startups — or about 15% of those that survive — produce a successful exit of $50 million or more across the top eight U.S. startup ecosystems."

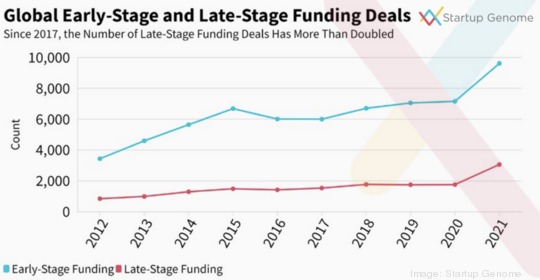

The growth over the past year has benefited companies at all stages. The average series A deal, for example, climbed to more than $18 million, a 239% increase from a decade ago. Since 2019, post-money valuations have climbed 125% for series B rounds.

Startup fundraising has been accelerating almost everywhere, with VC funding growing to $87.4 billion in Asia, $219.6 billion in North America and $12.9 billion in Latin America.

In the U.S., several metro areas have bolstered their startup ecosystems. Detroit ranked No. 1 among emerging startup hubs, with Minneapolis and Houston also cracking the top five.

Among big cities, Silicon Valley led the pack, which is not all that surprising, despite some companies leaving the Bay Area in search of lower costs of living or going fully remote following two years of pandemic-related office disruptions. But the trend is that more cities are attracting and retaining larger shares of tech talent.

More startups get $1 billion valuations

JF Gauthier, founder and CEO of Startup Genome, said the number of unicorns emerging over the past year is one of the most surprising trends in the report. At least 540 companies secured valuations of $1 billion or more in 2021. In Atlanta, that included Flock Safety, Stord and FullStory.

Phoenix, for example, has led the way among emerging startup ecosystems producing new billion-dollar companies. Four unicorn startups emerged there in the past decade, the report showed. While somewhat arbitrary in nature, having a startup with a billion-dollar valuation can be a game changer for a metro area, Gauthier said.

"Once you have a unicorn in your city, suddenly the ceiling is lifted and the definition of success changes," he said. "People say 'We can do it here. We can build a $5 billion company.' And that changes a lot."

Hyper-growth companies tend to churn out new founders and additional talent with experience in scaling a tech company at a rapid pace. They know how to reach international markets, raise bigger rounds of capital, expand operations and so on, he said.

"At one point they leave, there's an exit and it releases that great talent," he said. "This is a big deal when you have a first unicorn and it allows you to create several more a few years later."

'Silicon Valley has no monopoly'

For decades, Silicon Valley had an outsized share of talent, investment and attention in the tech world. That, Gauthier said, is changing quickly.

"Silicon Valley has no monopoly, no dominance on that," he said.

Gauthier expects growth to continue, even though it will be impacted by inflation and other factors: "I think this is a very long-term trend, and we're not in the middle of it. I think maybe at the end of the beginning, with tech becoming one of the main economic drivers all over the world."

Every time there's a crash, we think maybe it's an end of an era, he said.

"But the fact is we are transitioning to a digital economy, and there's a lot of industries that are yet to convert," Gauthier said. "And that's what's ongoing right now with deep tech where new technical skills, new technical innovation is finally changing those older industries. It's going to continue for a few decades."

Top 15 startup markets in the U.S.

- Silicon Valley

- New York City

- Boston

- Los Angeles

- Seattle

- Washington D.C.

- San Diego

- Chicago

- Denver-Boulder

- Austin

- Philadelphia

- Salt Lake-Provo

- Atlanta

- Dallas

- Miami

Source: 2022 Startup Genome report