In 10 years, Bitcoin has risen from a complicated, fringe concept to the verge of mainstream as the value skyrocketed to more than $34,000 in the first week of the year.

That value is a far cry from the currency that was initially worth mere cents when it started in 2011, costing more electricity to mine than its worth.

Now, Atlanta is poised to become a hub for the growing cryptocurrency market. As a global leader in payment processing, Atlanta has a legacy of financial technology companies and a foundation of companies already successfully operating in the cryptocurrency space.

Cryptocurrency in Atlanta

Atlanta is home to BitPay, which was founded in 2011 by Georgia Tech graduates Tony Gallippi and Stephen Pair, and is now the largest blockchain payments company in the world, said Sonny Singh, BitPay’s chief commercial officer.

BitPay allows companies, such as Microsoft or AT&T, to accept crypto payments on their websites and has processed more than $5 billion in cryptocurrency in the past 10 years. It has investments from Founders Fund, a Silicon Valley firm that invested in Airbnb and Spotify, and Atlanta’s TTV Capital, which focuses on fintech.

With BitPay’s growth leading the charge, Singh said Atlanta’s tech ecosystem could thrive as cryptocurrency becomes more popular.

“Right now, in America, there is no crypto hub yet,” Singh said. “Atlanta can really make itself into that hub. Having BitPay already based there gives it the foundation. And all these global fintech companies based in your backyard? That’s perfect.”

BitPay has a pending application with the federal Office of the Comptroller of the Currency to become a federally licensed bank, a move that would further push the cryptocurrency into mainstream recognition.

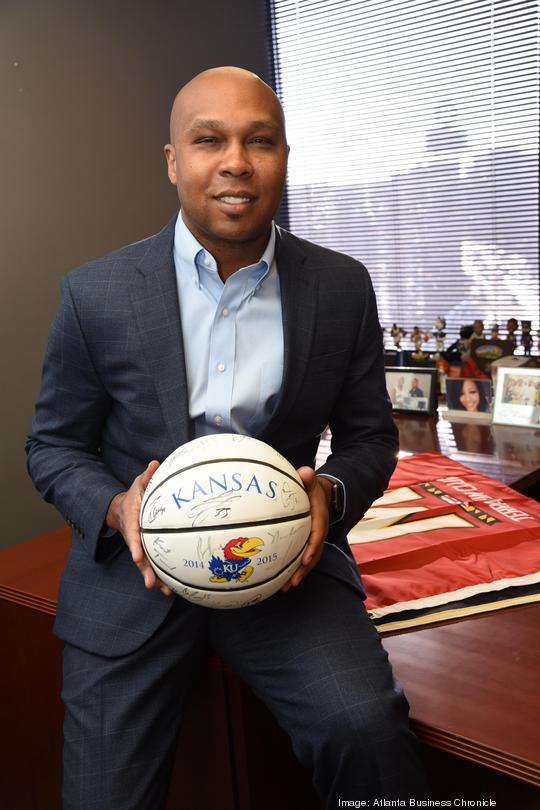

Bitcoin Depot, a local startup founded in 2016 by CEO Brandon Mintz, provides ATMs that convert cash into bitcoin and allows for bitcoin buying and selling. Mintz said the company adds 200-300 new machines every month to its current network of 1,500.

Bitcoin Depot has also launched the Bitcoin Depot Wallet, an app available on Google Play that can store your bitcoins. Mintz said he started the cash-to-cryptocurrency company after he spent three weeks in 2013 trying to figure out how to buy bitcoins.

"It’s all about expanding the footprint and making sure we reach as high a percentage geographically as possible of the U.S. population,” said Mintz, whose goal is to bring cryptocurrency to mass consumer markets.

Atlanta Executives You Should Get to Know

Investing in cryptocurrency could help people hedge inflation as Bitcoin’s value continues to grow, and it's a cheaper solution for global payment transactions, Mintz said.

Georgia Fintech Academy director Tommy Marshall also pointed to Bakkt, a cryptocurrency exchange provider created by the New York Stock Exchange’s parent company Intercontinental Exchange (NYSE: ICE), as a leader in the field. The company raised a $300 million round in March, tied with cybersecurity startup OneTrust for the largest funding round of 2020.

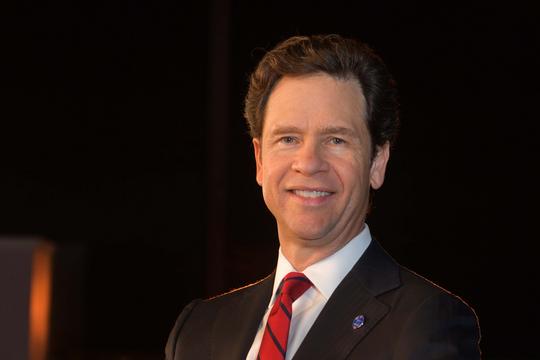

“We’ve got this advantage here in Atlanta because we’ve got these significant players — ICE, Bakkt and multiple companies with significant depth and expertise in payments,” said Marshall, who sees innovation from New York and San Fransciso being Atlanta’s main competitors in this space.

Opportunities for entrepreneurs

Atlanta has about two dozen companies operating with blockchain technology, which enables the cryptocurrency market but can be used for other data storage services, according to a 2019 Technology Association of Georgia report.

Those companies could all see growth as Bitcoin and blockchain become more accepted in the marketplace.

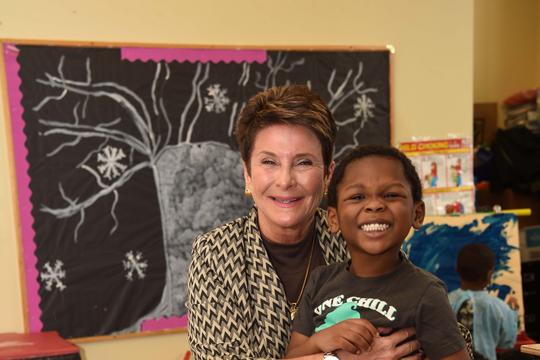

“The more and more normalization and acceptance of crypto, the better it is for these blockchain companies to continue to grow,” said TTV Capital partner Sean Banks, who's also the president of TAG’s Georgia Fintech Society.

Banks said entrepreneurs have an opportunity to hop on the growth by creating new tools that help Bitcoin integrate into existing payment markets to become as easy to use as credit and debt cards or cash.

For example, Verady, a startup out of Georgia Tech’s Engage incubator, specializes in tax accounting for cryptocurrency. Ryze, a Georgia Tech CREATE-X startup founded in 2019, helps consumers understand and invest in Bitcoin.

Singh sees established companies adding cryptocurrency functions in the future, which he said also gives Atlanta startups an edge on the crypto market because of the Fortune 500 companies based here.

“If UPS or Home Depot want to start doing crypto, they’re going to look to companies that are first in their backyard,” Singh said. “All of those big brands are going to look for partners to work with.”

But Banks doesn’t see Atlanta necessarily leading in the crypto marketplace. Because of the distributed and decentralized nature of cryptocurrency and blockchain, he said startups anywhere are positioned to thrive in the growing market.

And Atlanta’s payment processing giants have been slow to adopt cryptocurrency.

'Transaction Alley’ hesitations

About 70% of all credit card swipes and debit and gift card payments in the U.S. are processed through Georgia-based companies, which earned Atlanta the nickname of Transaction Alley.

Being a fintech and payment hub concentrates a lot of talent in Atlanta, but Singh and Banks said the larger companies, such as Global Payments and NCR, are more hesitant to move into the cryptocurrency market.

In October, two digital payments companies moved into the cryptocurrency market, which was part of the reason for Bitcoin’s price spike. Square invested $50 million in Bitcoin and PayPal started to accept cryptocurrency on its platform, but Singh doesn’t see Atlanta companies going the same route.

“That’s the difference between Silicon Valley companies that will be much more aggressive and willing to try new things,” Singh said. “Traditional, older fintech companies move a little slower. They’re not going to be the first one to jump in.”

Banks said the infrastructure of the cryptocurrency market does not match the current operating powers of those large payment processing companies, which may contribute to their hesitation to get into the market.

Once customers and investors become more comfortable with cryptocurrency and blockchain technology, Banks said he sees Bitcoin moving into the consumer market, but no one sees Bitcoin going away anytime soon.

“It’s become mainstream enough that executives and big Fortune 500 companies are now asking how to get involved,” Singh said.