Viva Finance, a 2021 Startups to Watch honoree, raised $6.2 million to expand nationwide, according to an Aug. 31 announcement.

The Atlanta financial technology startup provides loans based on employment history rather than just credit scores.

Inside the deal: Viva Finance says the Series A round was funded by “a diverse group of investors” but declined to give names. The startup previously raised $3.5 million, which included investments from the Atlanta Technology Angels and New York’s Acumen Fund, which also participated in this round. The announcement comes on the heels of an 800% year-over-year revenue growth, according to Viva Finance.

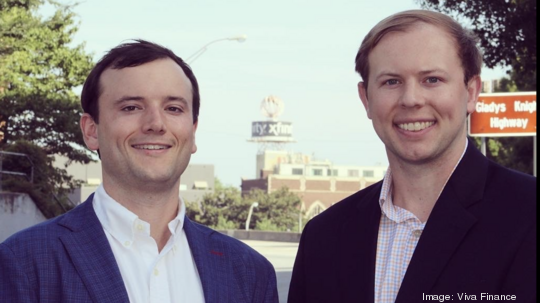

About the company: The startup, founded by brothers Jack and Hodges Markwalter in 2019, aims to make lending more inclusive by using employment history to screen applicants instead of just credit scores. That model became especially useful during the Covid-19 pandemic when people suddenly lost their jobs or faced hefty medical bills, the founders said. Read more here.

What’s next: The founders spent the past few years expanding throughout the Southeast and now plan to take the startup nationwide through increasing its marketing and technology capabilities. Viva Finance currently operates in 12 states and will focus first on the Texas and California markets. The round will also go toward doubling the 10-person staff, said Hodges Markwalter, chief operating officer.

Why it matters: Viva Finance’s growth reflects the growth of the alternative lending industry. Small businesses are shifting toward alternative lenders, according to Business Insider Intelligence’s 2020 Small Business Lending Report. Alternative lending platforms have better digital capabilities than conventional banks, making them more attractive to businesses because technology allows for faster and more personalized services. The same goes for consumers, who now expect their financial services to be online, according to the Oracle Financial Services Global Retail Banking Survey.

Atlanta’s reputation as a financial technology hub sets it to benefit from the rise of alternative lenders. One of the first alternative lending platforms was Kabbage, an Atlanta fintech success story that American Express Co. (NYSE: AXP) bought last year.

What they’re saying: “I am thrilled at the opportunity to amplify our nationwide impact and equip more consumers with the tools to achieve financial freedom,” Viva Finance CEO Jack Markwalter said in a statement. “This latest funding round will be instrumental in helping us to expand our mission of building an inclusive financial system.”